Call now to speak to a licensed agent

1-806-615-4420

Affordable Coverage. Clear Benefits. Real Protection.

Personalized life insurance to protect what matters most

At Total Access Health, we understand that securing your family's financial future is a top priority. Our personalized life insurance plans are designed to provide peace of mind and financial stability, ensuring that your loved ones are protected no matter what life brings.

Why Life Insurance Matters?

Income Replacement: Ensure your family maintains their standard of living in your absence.

Debt Coverage: Prevent outstanding debts, such as mortgages or loans, from becoming a burden to your loved ones.

Education Funding: Secure funds for your children's education and future endeavors.

Final Expenses: Cover funeral costs and other end-of-life expenses, alleviating financial stress during difficult times.

Before selecting a life insurance policy, your insurance advisor will likely conduct a comprehensive review of your financial situation, ask about your health history, and inquire about your long-term financial goals. They may also evaluate the following aspects:

Coverage Needs Assessment:

Analyzing your current and future financial obligations, such as mortgage, education costs, and living expenses, to determine the appropriate amount of coverage.

Beneficiary Designation:

Discussing your wishes regarding the designation of beneficiaries and ensuring that your policy aligns with your estate planning goals.

Policy Options and Riders:

Exploring different types of policies, such as term or whole life insurance, and discussing any additional riders, like critical illness or disability coverage, that may enhance your protection.

Health and Lifestyle Review:

Reviewing your medical history, lifestyle habits, and any pre-existing conditions to assess the risk and determine the premium rate.

Frequently Asked Questions

What types of life insurance policies are available?

Term Life Insurance: Affordable coverage for a specified period (e.g., 10, 20, or 30 years), ideal for covering temporary needs like a mortgage or children's education expenses.

Whole Life Insurance: Lifetime coverage with a cash value component that grows over time, offering both protection and a financial asset.

Universal Life Insurance: Flexible coverage that combines lifelong protection with investment options to build cash value.

How much life insurance coverage do I need?

The amount of life insurance you need depends on your financial obligations, such as mortgage payments, outstanding debts, future education costs, and your family's living expenses. A general rule of thumb is to have coverage that is 5-10 times your annual income, but this can vary based on individual circumstances.

Can I change my life insurance policy after purchasing it?

Yes, many life insurance policies offer flexibility. You may be able to adjust your coverage amount, convert a term policy to a whole life policy, or add riders for additional benefits. It's important to review your policy regularly and discuss any changes with your insurance advisor to ensure it continues to meet your needs.

Client Testimonials

Justin S.

Fort Lauderdale, FL

"Thanks to Total Access Health, I found a life insurance policy that fits my budget and gives me peace of mind knowing my family is protected."

Nora D.

Miami, FL

"The team at Total Access Health took the time to understand my needs and provided a tailored solution that exceeded my expectations."

The best plans to suit your needs.

We are committed to helping families, individuals, and groups get the absolute best health insurance coverage for their unique needs. Get quotes for individual, family health, group, dental/vision, and life insurance.

Let’s Get You Covered

Email: [email protected]

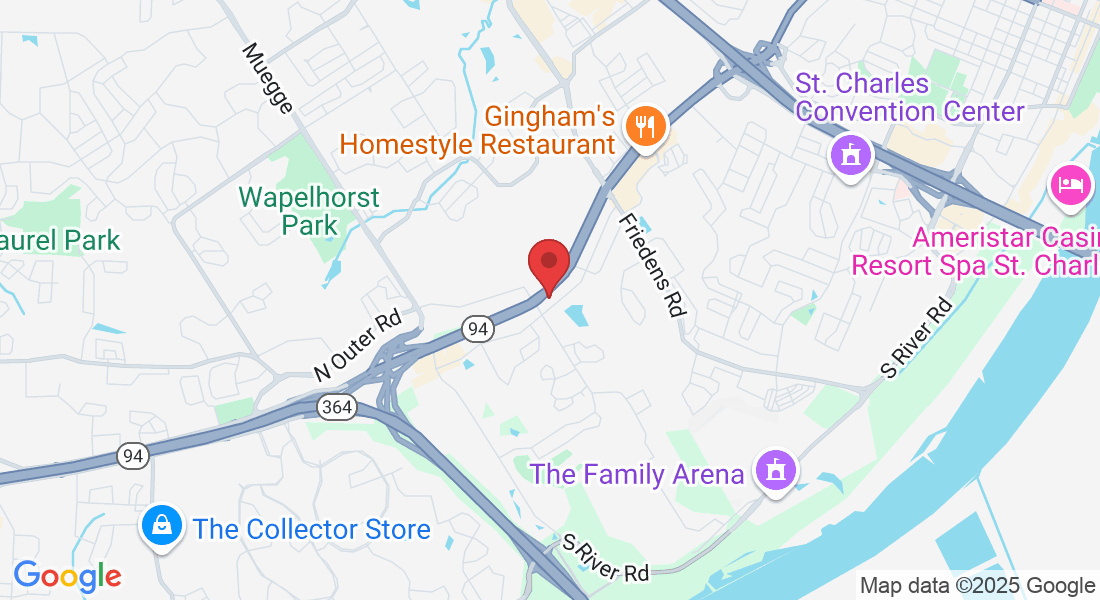

Address

St. Charles, MO

1985 Bluestone Dr St. Charles, MO 63303

Assistance Hours

Mon–Fri: 9am–6pm

Sat & Sun: CLOSED

Phone Number: